How to Lose $20 billion or What Happens when the Big Swinging Dicks of Finance Suffer a bad case of Blue Balls

The world of high finance has produced its share of giants - individuals who, through a mix of talent, risk-taking, and an unrelenting drive, have amassed vast fortunes and reshaped industries.

Carl Icahn, Ron Perelman, and Steve Schwarzman walk into a bank - except it’s more of a stumble for the first two. These guys were the original big swinging dicks of Wall Street, lording over hostile takeovers, debt-fuelled acquisitions, and private equity empires like it was a never-ending Monopoly game. But as we’ve learned, even the biggest egos eventually suffer from a serious case of blue balls.

Carl Icahn made his career by raiding companies, dismantling them, and walking off with a truckload of cash almost like he was robbing banks in broad daylight. Icahn’s biggest hit came in the '80s when he took over the airline TWA and other giants. He became the corporate raider - slick, ruthless, and always a step ahead. But here’s where it gets interesting: instead of cashing in and riding off into the billionaire sunset, Icahn kept playing the game like a degenerate gambler at the blackjack table.

He couldn’t stop. One of his longest obsessions? Shorting Herbalife. That’s right - he spent years betting the nutrition company would crash and burn, going head-to-head with fellow billionaire Bill Ackman. It worked, but let’s be honest - it was the financial equivalent of winning a pissing contest.

But then, because the guy couldn't just enjoy this success, Icahn floated his empire, Icahn Enterprises, on the stock market and paid out ludicrous dividends to attract investors. Hindenburg Research came along, called his bluff, and essentially said Icahn’s fund was a Ponzi scheme. The market listened, and Icahn’s $23 billion fortune got chopped down to $3 billion faster than you could say "overleveraged." Carl, ever the cocky raider, got raided. Blue balls.

And then there’s Ron Perelman, a guy who never met a company he didn’t want to buy with someone else’s money. He amassed a staggering fortune by acquiring anything that wasn’t nailed down, and his biggest obsession? Revlon. His love affair with the struggling cosmetics giant was as ill-advised as a midlife crisis Ferrari. He snapped it up in 1985, thinking he’d turn it into the next big thing - Revlon that is, not Ferrari. Stay with me... Instead, it became his financial ball and chain. Revlon was never quite the comeback story he hoped for, and as the beauty industry shifted, Revlon’s market share tanked.

But Perelman wasn’t about to admit defeat. No, instead he doubled down, borrowing billions to keep his empire afloat like a debt-addicted gambler chasing losses. You know, like leveraging the clapped out Ferrari when you should have just taken the hit and traded it in.

Cue the pandemic in 2020, and Revlon filed for bankruptcy, along with the rest of Perelman’s overleveraged portfolio. In just a few years, his net worth dropped from $19 billion to “fire-sale-everything-I-own” territory. He unloaded art, homes, yachts - whatever he could get his hands on. The guy went from kingpin to pauper so fast, his head’s still probably spinning. His love affair with Revlon? Pure blue balls.

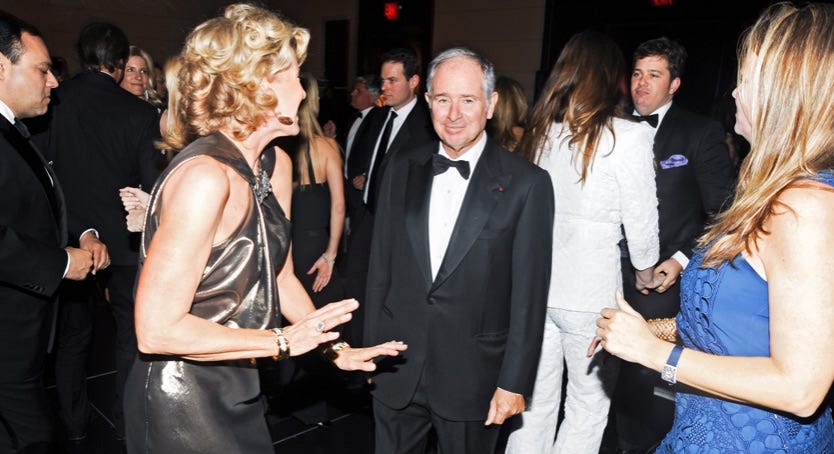

Meanwhile, Steve Schwarzman’s sitting on his $50 billion like the world’s most boring rich guy. Schwarzman, co-founder of Blackstone, didn’t get sucked into the same ego-driven madness as Wall Street wolves Icahn and Perelman. He built an empire too, but here’s the twist - he did it with discipline. Shocking, right? Instead of playing fast and loose, he built Blackstone into a trillion-dollar asset management firm, methodically investing in private equity, real estate, and alternative assets without getting sucked into overleveraging or crazy bets on failing companies.

Schwarzman’s approach was simple: surround yourself with experts, make decisions that actually make sense, and don’t get high on your own supply. He’s still sitting pretty while Icahn and Perelman are licking their wounds. Why? Because while they were swinging for the fences, he was content to play the slower, longer game - no crazy risks, no blue balls.

At the end of the day, even the biggest egos can’t escape the market’s reality check. Icahn and Perelman thought they could outsmart the system forever, but it turns out the system has a funny way of kicking you in the teeth when you least expect it. They wanted to keep playing the game, no matter the cost. Schwarzman? He was smart enough to quit while he was ahead, leaving the other two to suffer from the worst case of billionaire blue balls Wall Street has ever seen... Perhaps a cautionary tale in this AI fuelled, fast-buck world.

Keep up to date with The Letts Journal’s latest news stories and posts at our website and on twitter.