The Venture Capital Comedy Show: Why We're Still Building Startups Like It's 1999.

Are VCs Building Tomorrow's Tech Companies With Yesterday's Tools?

So, our mothership, LettsGroup, recently dropped an analysis that basically asks: "Why are we still building startups like we're using dial-up internet and carrying Nokia bricks?"

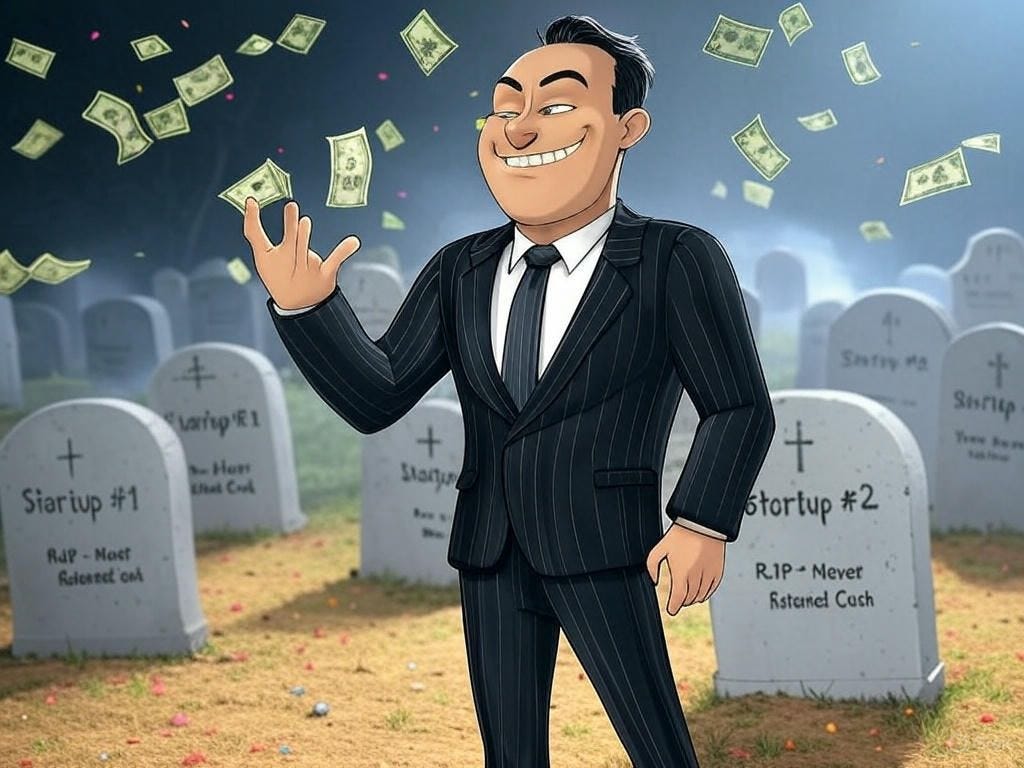

Let's have a laugh at the absurdity of it all: 75% of venture-backed companies never return cash to investors. If airlines had a 75% crash rate, we'd all be taking trains. If restaurants poisoned 3 out of 4 customers, Gordon Ramsay would have a coronary. But in the VC world? We call it "portfolio theory" and pretend it's genius.

The analysis brilliantly skewers what they call the "artisanal approach" to building startups. Picture a founder in a hipster apron, hand-crafting a business plan while muttering, "This is how grandpappy built his startup." Meanwhile, the rest of the world has moved on from artisanal to automated in practically everything except, apparently, how we build multi-million-pound tech companies who sell tech efficienicies to other companies. It's a bit like your plumber telling you not to drop by his house because the plumbing's a mess!

My favourite bit? Highlighting how 60% of UK startups fail within three years. That's worse odds than a coin toss! You'd think with those statistics, we'd have changed something by now. But no, we're like those people who keep hitting the same button on a broken vending machine, expecting different results.

The analysis points out that 80% of VC firms are cramped into London like sardines in a tin. No wonder they all end up investing in the same types of companies - they're probably all drinking at the same overpriced Shoreditch bars, sharing the same increasingly lukewarm tips.

And the "valley of death" funding gap? More like the "Grand Canyon of Death," with 60% of pre-Series A companies plummeting into the abyss before reaching Series A. It's like watching lemmings in suits with PowerPoint presentations. Did they spend their Seed cash too fast? Like a wide-eyed teenager on their first trip to Vegas.

The foreign investment stats are particularly giggle-worthy. When 94% of larger funding rounds include foreign investors, we're essentially running a sophisticated startup daycare - nurturing UK companies until they're old enough to be adopted by American parents who get to claim all the glory.

LettsGroup believes their AI VentureFactory could double success rates from the industry's one-in-ten hit rate to one-in-five. Still not Vegas odds, but hey, it's better than the current "throw spaghetti at the wall" methodology.

Their Innov@te system has seven stages and 49 steps, which honestly sounds like assembling IKEA furniture. But if we can put together a BILLY bookcase that doesn't collapse immediately, maybe we can build startups that don't implode within 36 months.

Will founders embrace this change? Who knows. Founders love their "visionary intuition" like cats love cardboard boxes - irrationally and with hissing when you try to introduce alternatives.

But as LettsGroup so cleverly points out, the old "seat-of-the-pants" approach is giving us a collective wedgie. Perhaps it's time we considered that in a world of self-driving cars and AI that can write poetry, we might want to upgrade our startup-building methods from "gut feeling and Excel" to something slightly more sophisticated.

Keep up to date with The Letts Journal’s latest news stories and posts at our website and on twitter.