Unleashing the Mammoth: Inside the Billion-Dollar Vision of Colossal's Genetic Resurrection

Embracing the Silicon Valley mindset, Colossal blends science and storytelling. Pitches de-extinction as a planetary imperative, secure funding with celebrities, for a movement, not just an idea

In today's venture capital ecosystem, where disruption is the default and buzzwords are the currency, nothing exemplifies innovation's next frontier like Colossal. This Dallas-based biosciences startup has raised over $225 million to genetically resurrect extinct species. They started with the dire wolf - declared victory after creating what's essentially a husky with identity issues - and now they're moving on to the woolly mammoth. It's Silicon Valley's approach to science: why cure diseases when you can turn Jurassic Park into a pitch deck and Ice Age into a business plan?

While other companies solve boring problems like antibiotic resistance, Colossal dared to ask: What if Ice Age elephants could make a comeback and also be really photogenic on Instagram? And VCs? They answered - with checkbooks. Presumably because they like Steve Jobs, Disney, Pixar and Ice Age aka super-kitch movies - probably in that order.

Colossal isn't just re-engineering woolly mammoths for nostalgia; it's building a platform for species de-extinction™. Their goal? Bring back the mammoth in the name of climate change, conservation, and - eventually - mammoth-themed NFTs. Investors include Paris Hilton (yes, that one), Peter Thiel (of course), and top-tier VC firms captivated by climate-resilient pachyderms with venture-backed cool factor. As one VC explained: "It's the perfect mix - climate, biotech, storytelling, and licensing opportunities [with Disney/Pixar/Paris H]."

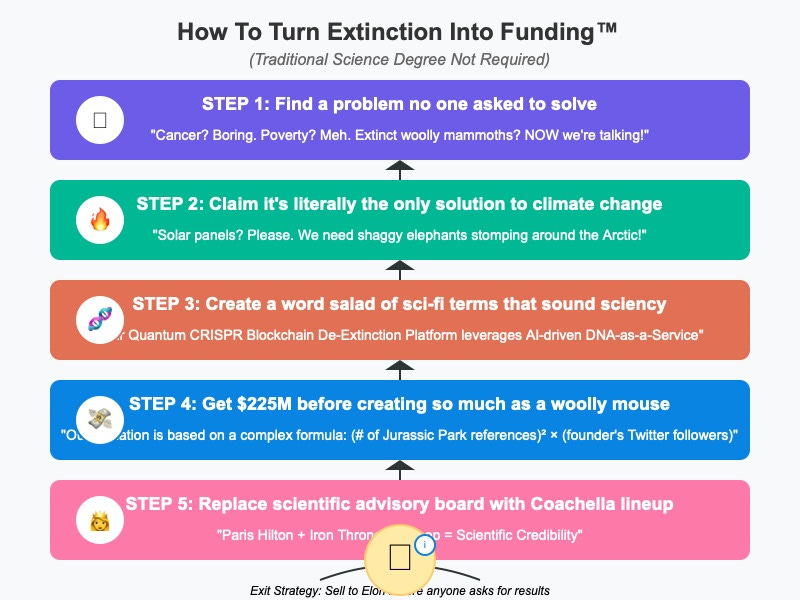

The New Scientific Method (VC Edition) follows a simple formula: First, identify a problem science hasn't solved - because it probably shouldn't. Who needs food security when you can bring back Ice Age animals? Next, reframe it as a planetary imperative only Silicon Valley can fix. Climate change? Sure. But how do we leverage genetic de-extinction to make it cool?

Then, deploy high-risk buzzwords like ' de-extinction,' 'CRISPR platforms,' and 'DNA-as-a-Service' in your pitch deck alongside stock footage of a mammoth walking majestically through foggy tundra. Fourth, secure eight-figure funding before any proof of concept . In venture capital, promise attracts millions. Just ensure your founders are old enough (because Mammoths aren't young), charismatic, and have a track record of failing upward.

Finally , announce partnerships with celebrity conservationists, ideally ones who once DJed at Coachella. This is what elevates your pitch from “idea” to “movement.” Who needs a scientific consensus when Paris Hilton is backing it, surely that's proof enough of global impact potential.

Gone are the days when biologists drove the future of genetic science. Today, real progress is guided by founders with impeccable storytelling instincts, TEDx-ready charisma, and the ability to say “existential risk” while holding a glass of biodynamic wine.

Traditional scientists have raised concerns that de-extincting species could create ecological imbalances, undermine current conservation efforts, or lead to an eventual Netflix docuseries titled “Oops: The Mammoth Uprising.” But in venture capital, concerns are just another form of early user feedback. Colossal's founder explained, "This isn't just about the mammoth. It's about building a platform for reversing extinction. Imagine choosing your own ecosystem!" And if that ecosystem includes a saber-toothed tiger sponsored by Red Bull? Even better.

What makes Colossal particularly exciting to investors isn’t just the potential to reshape entire ecosystems - it’s the optics. Unlike boring biotech startups working on invisible molecules that save lives, Colossal offers visual deliverables : elephant-shaped genetic marvels stomping across Arctic landscapes like nature’s original influencers. VCs dream of the ultimate exit: a multibillion-dollar IPO, a SPAC merger with Disney's Animal Kingdom, or an acquisition by Meta for virtual mammoths in the metaverse.

As one investor put it: "Colossal isn't just a company - it's a brand with tusks."

In the end, Colossal perfectly embodies modern venture capitalism: high-concept, high-risk, and shrouded in buzzwords like "radical impact" and "synthetic biodiversity." Because in 2025, it's not about solving today's problems. It's about solving yesterday's problems using tomorrow's tech - preferably with a creature that went extinct before humans had even invented shoes.

So the next time you see a massive, shaggy behemoth wearing an Apple AirTag, don't panic. That's just the future of innovation - brought to you by Series C funding and the firm belief that anything is possible if you have a great narrative and the Hemsworths on your cap table.

Keep up to date with The Letts Journal’s latest news stories and posts at our website and on twitter.